Horizon has previously owned a number of royalties and rights linked to producing, development and exploration projects which provide current or potential revenue streams to support ongoing activities.

Yarmany West

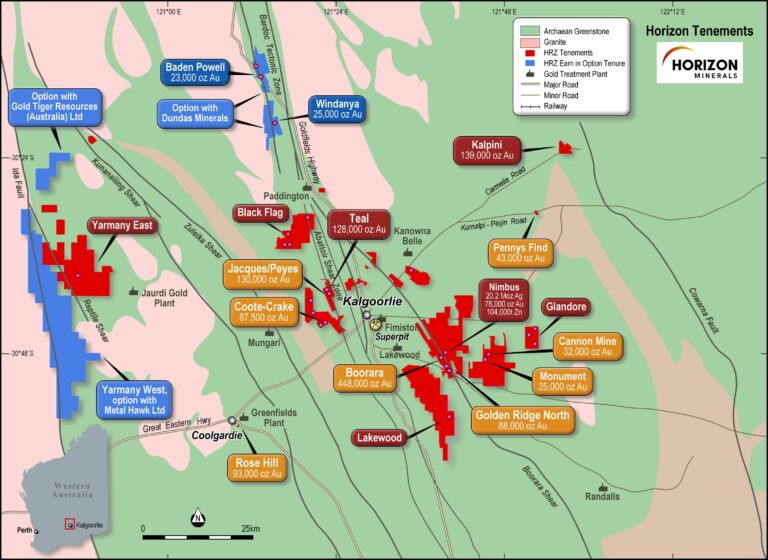

The Yarmany West area is under an earn-in option with Metal Hawk Limited (ASX: MHK) which is targeting the Ida Fault area for lithium bearing pegmatites and nickeliferous ultramafics. Metal Hawk has recently commenced drilling at the F Camp lithium prospect where anomalous surface rock chips and geochemistry were noted. Horizon retains the right to a 20% free carried interest to a decision to mine in the Yarmany West project under the option agreement

baden powell and windanya

In August 2023, Dundas Minerals Ltd entered into a binding agreement with Horizon to acquire the Windanya and Baden-Powell/Scotia gold projects.

Summary of Key Terms

Dundas Minerals has acquired a 2-year Option to purchase the Windanya and Baden-Powell tenements (“Projects”) from Horizon Minerals Limited’s 100% owned subsidiary Black Mountain Gold Limited, in accordance with the following terms:

- $125,000 (plus GST) option fee payment within 5 business days of signing, and the issue of 3,234,327 fully paid ordinary shares of Dundas Minerals at $0.0773 per share ($250,000 plus GST), which will be subject to a voluntary Escrow period of 6 months.

- An anniversary payment of $125,000 cash (plus GST) within 5 business days of the first anniversary of signing.

- Upon Option exercise, which is not available until the anniversary payment is made and a minimum of $500,000 of on-ground exploration is completed on the projects, an exercise price of $1,000,000 (plus GST) is payable to Horizon as cash or shares, or a combination of cash and shares at the election of Dundas Minerals, for an 85% interest in each of the tenements, with Horizon retaining a 15% free carried joint venture interest until a Decision to Mine is made on any prospect within any of the tenements. Should the Horizon joint venture interest dilute to 5% it can elect to convert to a 2.5% net smelter royalty capped at 50,000 ounces Au (or equivalent).

- Horizon will have priority ore processing rights from the tenements to process ore through secure processing arrangements that are on equal or better terms than other processing alternatives available to the Joint Venture.

AREA 54

In 2021, divestment of non-core Area 54 prospect, 70km NW of Coolgardie to Gold Tiger Ltd for $120,000 cash payable over four years and spending a minimum of $300,000 over the same period to earn 90%.