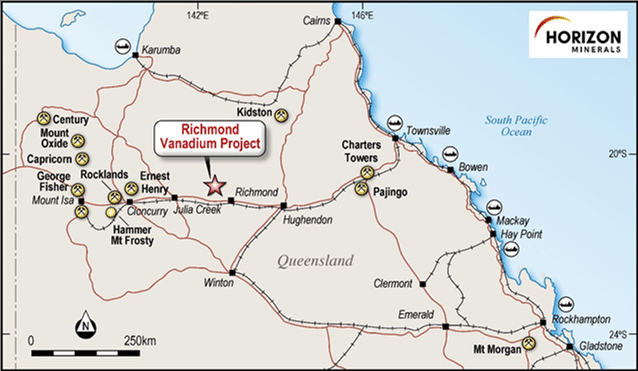

The Richmond Vanadium project lies on the Flinders Highway and Great Northern railway, 500km west of the Townsville port and 250km east of Mt Isa. The project comprises four main prospects in the Richmond and Julia Creek districts covering an area of 1,520km2.

In March 2017, the Company entered a strategic development Joint Venture (“JV”) with Richmond Vanadium Technology Pty Ltd (“RVT”). The JV covered Horizon’s 100% interest in the Richmond vanadium project comprising 1,550km2 of Cretaceous Toolebuc Formation.

The JV (25% HRZ and 75% RVT) owns 100% of five Mineral Exploration Permits (EPM25163, EPM25164, EPM25258, EPM26425 and EPM26426) covering 481 Blocks near Richmond and 100% of the metal rights to Global Oil Shale Plc’s Julia Creek (Burwood) MDL522.

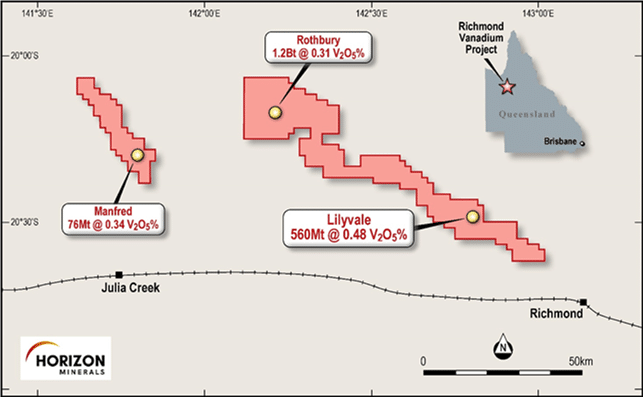

The JV conducted additional drilling in 2019 and updated the Mineral Resource Estimate in 2020 in line with the JORC 2012 Code to:

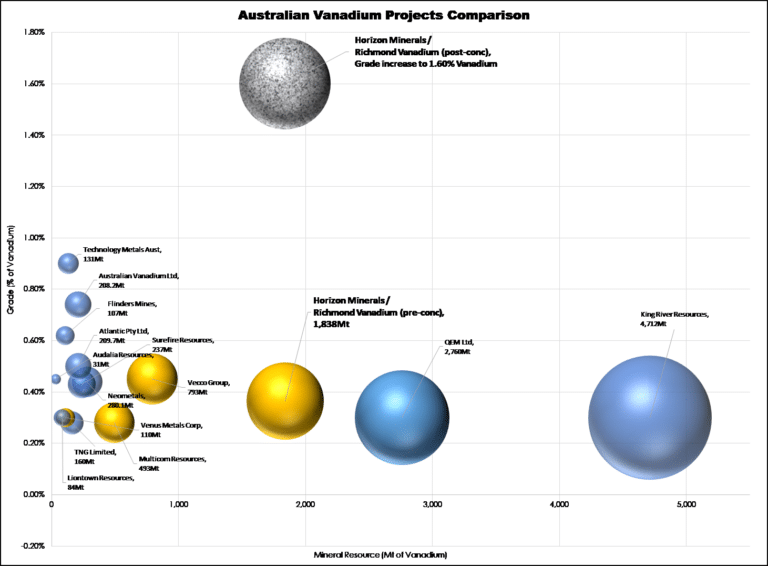

1,838 Mt at 0.36% V2O5 and 256 g/t MoO3 at a 0.30% V2O5 lower cut-off grade.

The scale of the project places it as one of the largest undeveloped vanadium resources in the world, with the project included in the Australian Government’s Critical Minerals Prospectus in 2020 and 2021.

PRE-FEASIBILITY STUDY

Pre-Feasibility Study (PFS) Parameters

The PFS was based on the following key parameters:

- Vanadium price of V2O5 Flake of A$16.44/lb

- Exchange rates of US$0.73 and RMB4.55 to the Australian Dollar

- Open pit mining operations conducted by contractors

- Ore processed on site to produce a V2O5 concentrate of 1.82% V2O5, railed to port and shipped overseas for refining V2O5 flake

- Project implementation and oversight by RVT’s team in conjunction with contractors

Study Team

The key consultants and companies engaged during the Study and their areas of responsibility were:

- Feasibility Study Management – Faultzone

- Geology and Resource Estimates – RVT

- Mining and Ore Reserve – Dr Dawei Xu

- Metallurgical Test work – Hunan Nonferrous Metal Research Institute

- Processing facility and infrastructure – Faultzone

- Power Study – Ergon Energy Corporation Limited

- Hydrology and hydrogeology – CDM Smith

- Environmental – Epic Environmental Pty Ltd

Key Outcomes of the Pre-Feasibility Study

The key Study outcomes for the project are included in the Table below.

The PFS estimated Ore Reserve, which constitutes 100% of the production target, has been prepared by Competent Persons in accordance with JORC Code 2012, and contains 459Mt @ 0.5% V2O5 (Reserve of 100+ years).

A total of 8.4Mt of total material is mined per annum, generating 4.06Mt of ore mined from the open pit for concentration. This mining rate yields a nominal mine life of over 100 years at Lilyvale. For the purposes of the economic analysis in the PFS, a mine life of only 20 years is considered.

| Measure | PFS outcome Study Price (A$16.44/lb) |

|---|---|

| Life of Mine (Total 110 years) | |

| Total pit volume (Mt) | 951.7 |

| Stripping ratio (waste: ore) | 1.07 |

| Mined ore (Mt) | 459.2 |

| Ore Grade V2O5 (%) | 0.49 |

| PFS (Initial 20-year life) | |

| Mined ore (Mt) | 80.4 |

| Ore Grade V2O5 (%) | 0.49 |

| Concentrate Produced V2O5 (Mt) | 15.64 |

| Concentrate Grade (%) | 1.82 |

| Refining recovery average (%) | 86.1 |

| V2O5 98% Flake Produced (kt) | 251.5 |

| Capital costs ($M) | A$243.0 |

| Operating costs ($/lb) | A$8.66 |

| NPV @ 10% ($m) | A$1,019 |

| Payback (years) | 1.9 |

| IRR | 62% |

Table 1: Summary of PFS key outcomes 2

The PFS has an annual rate of production of 790,000 tonnes of concentrate, producing 12,701 tonnes of 98% V2O5 flake. Operating costs of A$8.66/lb include mining, administration, concentration onsite, transport and refining offshore.

Capital costs of A$243.0m include construction of the concentrator via EPCM inclusive of 20% contingency, in addition to a power station, railway siding, bores, administration and accommodation facilities, and an offshore refining plant.

Mining capital is provided by the contractor and amortised into the mining rate.

Consideration for refining onshore in regional Queensland was examined in the PFS but discounted at the time due to the high differential in capital and operating costs impacting the projects NPV. As part of the DFS to be completed in 2023, onshore refining will be re-evaluated with the Company’s preference to produce final product in Australia for domestic use in electrolyte and vanadium redox flow battery manufacture.

Demerge and IPO for the Richmond - Julia Creek Vanadium Project

The Richmond – Julie Creek Project has many favourable attributes supporting a future development including shallow, continuous mineralisation, a long mine life, modest upfront capital costs and attractive forecast financial returns. The Project is located in a mature mining region with established infrastructure including a sealed highway, railway network and port.

Vanadium has been declared a critical mineral by the Australian Government and United States Department of Interior and has a positive demand outlook. A key driver of the expected future demand for vanadium is from use in vanadium redox flow batteries which have many advantages over alternative storage methods when it comes to applications for stationary, grid-scale storage in grid or off-grid settings. This supports the use of vanadium redox flow batteries in storing electricity produced by renewable sources.

By demerging the Project into the IPO vehicle with its own funding and dedicated Board and executive team, Horizon believes greater shareholder value can be achieved. The pathway will also allow Horizon to focus all of its resources on its advanced Western Australian gold assets and is consistent with the Company’s strategy of realising value for shareholders from its non-core assets.

On 13 December 2022, Richmond Vanadium Technology commenced trading on ASX with the code “RVT” following the successful IPO that raised $25 million (before costs).

Horizon Minerals Limited currently has a holding of 19,833,363 RVT Shares which are escrowed to 13 December 2024.